FREE ZONE DMCC

Why Choose DMCC in Dubai

Established over a decade ago in 2002, DMCC (Dubai Multi Commodities Centre) has become the largest free zone in the UAE, offering a wide range of benefits to businesses that incorporate there. With over 15,000 companies calling the DMCC their base, you’ll be in good company.

About the Dubai Multi Commodities Centre (DMCC)

DMCC is one of the most well-established free zones in the UAE and is home to over 15,000 businesses. The DMCC is open to most types of business activity and offers a range of flexible office options. Pricing for company formation in DMCC starts at AED 50,000 and DMCC company formation typically takes 4-5 weeks.

Like other Dubai free zones, DMCC benefits from being within one of the best cities in the world, offering extensive direct travel links all over the world, along with a high quality of life that can be found in few cities. The DMCC is just a 14-minute drive from downtown Dubai.

Benefits of DMCC Company Formation

100% Ownership

Company formation in DMCC allows you to retain 100% ownership over your company and requires no Emarati shareholders.

Repatriation

You can repatriate your profits to your home country without any restrictions or penalties.

Warehouse Options

Forming a company in DMCC means you can own a warehouse in JAFZA or Al Quoz.

Central Location

DMCC is just 14 minutes by car from downtown Dubai and within easy reach of both airports and Jebel Ali Port.

Networking Opportunities

With over 15,000 businesses operating out of this free zone, there are plenty of people around to network with. If you’re enterprising, this could lead to plenty of opportunities for your business.

Flexible Office Space

Like most other free zones, DMCC provides ample office space options. Whether you need a single flexi-desk or multiple floors in a serviced office block, you’ll find the space you need.

Business Activities in DMCC

DMCC offers a wide range of business activities and you can choose 6 activities in one category, so you won’t feel limited in the ways you can do business. Some of the most common business activities are:

- Trading

- Accounting

- Manufacturing

- Consulting

- Education and Training

- Events Management

DMCC Free Zone Business Setup: The Essential Guide

Looking to establish a business in Dubai? The Dubai Multi Commodities Centre (DMCC) free zone is your ideal destination. As the world’s largest free zone, DMCC offers a plethora of advantages to businesses choosing to operate within its boundaries.

This comprehensive guide will walk you through the key aspects of DMCC company formation, such as licensing requirements, available services, and getting started.

If you’re keen on starting a business in Dubai, keep reading!

DMCC Company Formation: An Overview

Located in the heart of Dubai, DMCC is a free zone established in 2002, now recognized as the largest of its kind in the world.

A “free zone” refers to an area where businesses benefit from specific tax exemptions and regulatory leniency, making it an attractive option for entrepreneurs seeking to establish a business in Dubai.

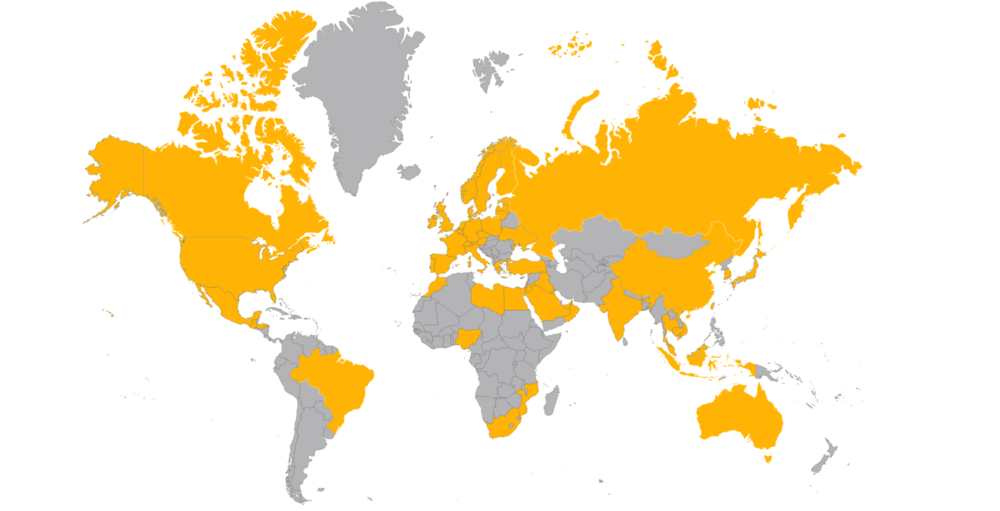

Home to over 11,000 companies from more than 120 countries, DMCC houses businesses from diverse industries like commodities trading, logistics, banking, and insurance.

With its liberal business rules and tax-free environment, DMCC has become an increasingly popular choice for companies looking to tap into global markets. Serving as a vital link between international trade routes, DMCC is instrumental in promoting worldwide commerce.

- Key benefits of setting up shop in DMCC include:

- 100% foreign ownership

- No personal or corporate taxes

- A broad spectrum of business services

- Hassle-free company formation

- Licensing Requirements

- To establish a company within the DMCC free zone, you must obtain

a license. - The process can be complex, with multiple licensing options available.

The most common licenses are the DMCC Trading License and DMCC Service License. The Trading License permits businesses to operate in Dubai, while the Service License allows the provision of services related to your business.

To acquire a license, you must meet specific eligibility criteria. You need to be a registered company with a physical presence in the UAE, have a local service agent, and ensure your business activity complies with DMCC regulations.

The DMCC Trading License and DMCC Service License cost AED 15,000 and AED 25,000, respectively.

To simplify the licensing process and application submission, you can contact us at Global Success Consulting. We’re here to help you right away!

Services Available at DMCC

DMCC is home to a diverse range of businesses, including banks, law firms, accounting firms, and logistics companies. Additionally, DMCC provides several services that businesses can utilize.

Popular services offered by DMCC include:

- Company setup and registration

- Licensing and regulatory compliance

- Trade support and facilitation

- Business consulting

- Human resources and recruitment

- Marketing and communications

- IT and telecommunications

- Real estate assistance

Getting Started If you’re interested in conducting business in the DMCC free zone, the first step is to contact a local agent like us. We’ll guide you through the licensing process and offer advice on establishing your business in Dubai.

After obtaining your license, you’ll need to set up your company and register with DMCC, which can be done online or in-person at one of DMCC’s offices.

Once your company is registered, you can start doing business in Dubai. DMCC provides various resources to help businesses begin, including a business directory, a library, and an online portal.

Choose DMCC as your business hub in Dubai and benefit from 100% foreign ownership, zero taxes, and a wide array of services. Contact us today to get started!

Contact Us

Related Posts

- How to Setup a Company in Dubai: A Comprehensive Guide with Global Success Consulting in 2023

- Ultimate Guide 2024: Investing in Dubai’s Real Estate Market – To Buy or Rent?

- Dubai Off-Plan 2024: Unlocking Hidden Real Estate Gems

- Navigate UAE Tax Regulations: Avoid AED 10,000 Penalty with Timely Corporate Tax Registration

- Your Guide to Government-Approved Medical Centers for Expats in UAE

- Transforming Corporate Leadership in the UAE with Young CEOs and Advanced Gender Diversity

- Corporate Taxation for Non-Residents in the UAE: A Comprehensive Guide for 2024

- No Income Tax in the UAE: Unlocking Financial Freedom and Unprecedented Growth